Introduction to Budgeting Tools

Budgeting is an important part of personal finance and can help you manage your money effectively. With the right budgeting tools, creating and sticking to a budget is much easier. There are many different types of budgeting tools available, from simple spreadsheets to robust software. This article will provide an overview of 14 user-friendly and easy-to-use budgeting tools.

Best Budgeting Tools List

Spreadsheet Budget Templates

Spreadsheet software like Excel offers budget templates that provide a framework for tracking income and expenses. These templates require some manual entry, but they are simple to set up.

Basic Excel Budget Spreadsheet

Excel has free budget spreadsheets that let you categorize transactions and see summaries by week or month. Formulas track spending and can show you if you’re over budget. These spreadsheets work well for basic budgeting needs.

Mint Excel Budget Template

Financial software company Mint offers an Excel template optimized for tracking budgets. It includes visually appealing graphs and charts that provide insights into spending. And helpful formulas simplify managing budgets.

Google Sheets for Budgeting

Like Excel, Google Sheets has budgeting templates. Since it is cloud-based, Google Sheets enables real-time collaboration and access from any device.

Simple Household Budget Spreadsheet

This easy Google Sheets household budget template allows you to track monthly income, fixed costs, variable spending, and savings goals. Charts give you visual reports to see spending patterns.

Annual Budget Planner

For more extended budgeting, this annual Google Sheet template includes monthly and yearly views. You can track regular costs as well as plan for large annual expenses like vacations.

Budgeting Software Programs

For those wanting more advanced features, various budgeting programs and personal finance apps can help. Budgeting software often syncs with bank accounts for automatic transaction imports.

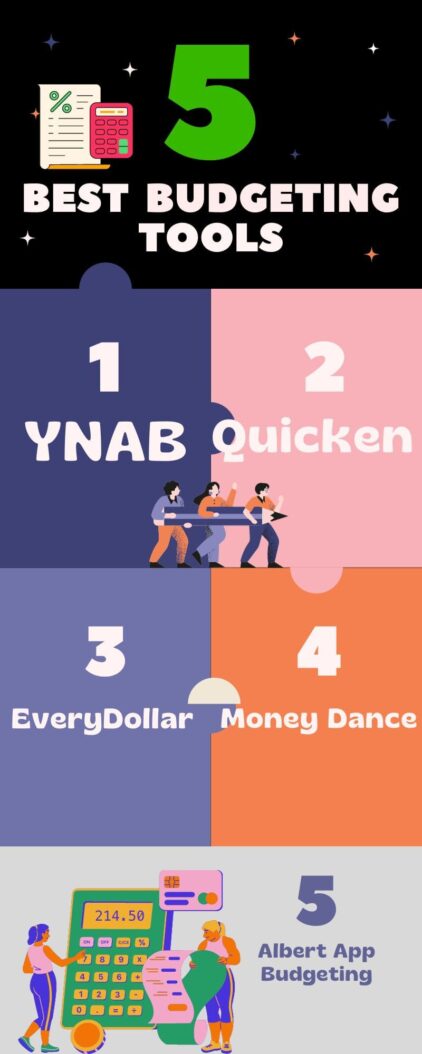

YNAB

You Need a Budget (YNAB) is popular online budgeting software that supports the envelope budgeting method. Income gets divided into digital envelopes for spending categories promoting mindfulness.

Quicken

Quicken offers robust features for managing finances including budgeting, bill pay, and investment tracking. It provides deep analysis of spending and helps optimize budgets.

Money Dance

Money Dance is a paid personal finance app with strong budgeting components. Useful features include reminders for bill pay, visual reports, and syncing between devices.

EveryDollar

EveryDollar takes a no-frills approach focused specifically on budget creation. It makes it easy to allocate spending to common categories each month to align with income.

Banking and Budgeting Apps

Many banks and financial apps now provide user-friendly budgeting capabilities. Integrating budgets with your accounts makes managing money simpler.

Envelope Budgeting Apps

Envelope budgeting apps like Goodbudget, YNAB, and Dave Ramsey’s EveryDollar operate similarly to digital envelopes. Just allocate money to virtually envelopes as needed.

Simple Bank Budgeting

Simple offers Goal and Spend accounts to organize saving and spending toward budgets. Auto-saving rules help meet targets and stats show burn rate tracking.

Albert App Budgeting

Albert examines income, bills, and spending to create a custom budget and provide alerts so you don’t overspend. Revising budgets is easy.

Specialized Budgeting Calculators & Tools

For specific budgeting needs, specialized tools provide shortcuts and templates. These simplify creating budgets tailored to your situation.

Annual Budget Calculator

This calculator from Simplepath makes budgeting for large, future expenses easier. Just enter costs, time frame to save, and it calculates the monthly savings required.

Wedding Budget Tool

Zola’s wedding planning tools include a customizable wedding budget calculator. Add details like number of guests and location for cost estimates.

Retirement Budget Tool

Vanguard’s free retirement income calculator helps those nearing retirement allocate savings and estimate spending budgets to last through all years.

Conclusion

Creating and managing a budget is essential for achieving financial goals, whether saving for a house, vacation, retirement, or just monthly necessities. Thankfully many types of budgeting tools from simple spreadsheets to robust software make it more realistic. The key is choosing a budgeting method that matches your needs and style. Simplify budgeting with one of these 14 user-friendly tools to help allocate your income effectively.

FAQs

What is the best budgeting app?

Some top-rated budgeting apps include You Need a Budget (YNAB), Mint, EveryDollar, PocketGuard, Albert, and Personal Capital. The best app depends on your needs and budgeting approach.

Is budgeting really necessary?

Yes, budgeting is crucial for managing finances, paying off debt, saving money, and achieving financial goals. Tracking income and expenses through budgeting helps align spending with your priorities.

How do I start creating a budget?

First, review recent bank statements to determine average monthly income and expenses. Next, categorize spending and allocate money to each fixed and variable expense category based on needs and priorities. Apps and tools can help with calculations.

What percentage of income goes towards budget categories?

Recommendations vary, but common budget category percentages include: Housing 35-50%, Transportation 10-15%, Food 10-15%, Savings 5-10%, Debt payments under 10%, Entertainment 5-10%, and Miscellaneous sinking funds 5-10%.

What happens if I go over my budget?

The best course if over budget is first to analyze expenses and determine where overspending occurred. Then explore options for increasing income or reducing other costs in the next month’s budget to account for and learn from the overage amount.