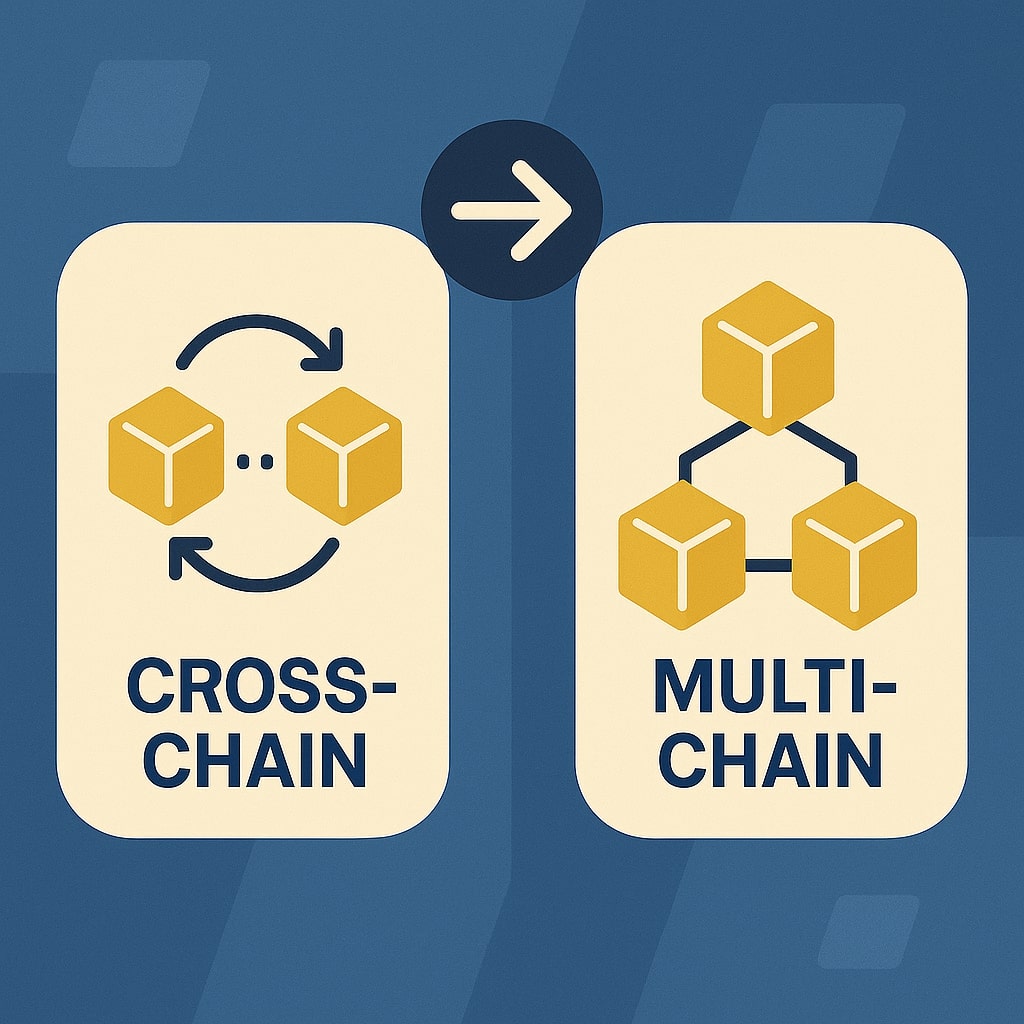

Blockchain technology has evolved beyond isolated networks to interconnected ecosystems. Understanding the distinction between cross-chain and multi-chain approaches is crucial for developers, investors, and users navigating the decentralized landscape. These two paradigms represent different philosophies for achieving blockchain interoperability, each with unique advantages and trade-offs.

The blockchain space in 2025 demands seamless connectivity between networks. Cross-chain solutions enable asset transfers and communication between existing blockchains, while multi-chain architectures create unified ecosystems with multiple specialized chains. This fundamental difference shapes how users interact with decentralized applications and how developers build scalable solutions.

Understanding Blockchain Interoperability

Blockchain interoperability refers to the ability of different blockchain networks to communicate, share data, and transfer assets. This capability addresses the fragmentation problem where valuable assets and applications remain siloed on individual chains.

The need for interoperability stems from blockchain trilemma challenges. No single blockchain can simultaneously achieve perfect security, scalability, and decentralization. Different networks optimize for specific use cases, creating specialized ecosystems that benefit from interconnection.

Interoperability solutions fall into two main categories: cross-chain bridges that connect existing networks and multi-chain platforms that deploy multiple interconnected chains from the ground up. Each approach tackles the same problem with different methodologies and architectural decisions.

What is Cross-Chain Technology?

Cross-chain technology enables communication and asset transfers between independent blockchain networks. These solutions act as bridges, allowing users to move tokens, data, and smart contract calls across different protocols without relying on centralized exchanges.

Cross-chain protocols typically involve locking assets on the source chain and minting equivalent representations on the destination chain. This process requires sophisticated verification mechanisms to ensure security and prevent double-spending across networks.

The technology relies on various consensus mechanisms, including validator networks, relay chains, and cryptographic proofs. These systems verify transactions on both sides of the bridge, maintaining asset integrity across different blockchain environments.

How Cross-Chain Bridges Work

Cross-chain bridges operate through several technical approaches. Lock-and-mint bridges secure original assets on the source chain while creating wrapped versions on the destination chain. Burn-and-mint bridges destroy tokens on one side while creating them on the other.

Atomic swaps enable direct peer-to-peer exchanges without intermediaries. These transactions either complete fully or fail entirely, preventing partial executions that could lead to asset loss. Hash time-locked contracts (HTLCs) provide the cryptographic foundation for secure atomic swaps.

Relay chain architectures use specialized validator networks to monitor multiple blockchains simultaneously. These validators verify cross-chain transactions and reach consensus on asset transfers, providing security through economic incentives and slashing mechanisms.

Popular Cross-Chain Protocols

Several prominent protocols have established themselves in the cross-chain ecosystem. Chainlink’s Cross-Chain Interoperability Protocol (CCIP) provides secure messaging and token transfers across multiple networks with enterprise-grade security features.

LayerZero offers omnichain applications that appear as single deployments while operating across multiple blockchains. The protocol uses ultra-light nodes and decentralized verifier networks to maintain security while reducing infrastructure requirements.

Wormhole connects over 20 blockchains through a guardian network that validates cross-chain messages. The protocol supports both token transfers and arbitrary message passing, enabling complex cross-chain applications.

What is Multi-Chain Architecture?

Multi-chain architecture involves deploying multiple interconnected blockchains within a single ecosystem. These chains share security models, governance structures, and often use standardized communication protocols for seamless interaction.

Unlike cross-chain solutions that connect existing networks, multi-chain platforms design their networks from inception to work together. This approach provides greater control over security, performance, and interoperability features.

Multi-chain ecosystems typically feature hub-and-spoke models where a central hub chain provides security and coordination for multiple application-specific chains. These specialized chains can optimize for particular use cases while maintaining ecosystem connectivity.

Multi-Chain Network Structure

Multi-chain networks employ various architectural patterns. Hub-and-zone models use a central hub for security and coordination while zones handle specific applications or user groups. This structure enables horizontal scaling without compromising security.

Parachain architectures allow multiple chains to share security through a relay chain. Each parachain can implement custom logic and governance while benefiting from the collective security of the entire network.

Subnet models enable the creation of custom blockchain networks with configurable validators, virtual machines, and consensus mechanisms. These subnets maintain independence while leveraging shared infrastructure and security features.

Leading Multi-Chain Platforms

Cosmos pioneered the multi-chain approach with its Internet of Blockchains vision. The ecosystem uses the Cosmos Hub as a central coordinator and Inter-Blockchain Communication (IBC) protocol for secure chain-to-chain transfers.

Polkadot’s relay chain provides shared security for up to 100 parachains. Each parachain can implement unique features while benefiting from the relay chain’s validator set and finality guarantees.

Avalanche’s subnet architecture allows unlimited custom blockchains with configurable parameters. Subnets can define their own virtual machines, consensus mechanisms, and validator requirements while maintaining network interoperability.

Core Differences: Cross-Chain vs Multi-Chain

| Aspect | Cross-Chain | Multi-Chain |

|---|---|---|

| Architecture | Connects existing blockchains | Deploys interconnected chains |

| Security Model | Relies on bridge validators | Shared security across ecosystem |

| Development Approach | Retrofit connectivity | Built-in interoperability |

| Governance | Independent chain governance | Ecosystem-wide coordination |

| Scalability | Limited by bridge capacity | Horizontal scaling through new chains |

| Trust Assumptions | Bridge security critical | Ecosystem security model |

The fundamental architectural difference shapes all other aspects of these approaches. Cross-chain solutions must work within constraints of existing networks, while multi-chain platforms can optimize the entire ecosystem for interoperability.

Technical Architecture Comparison

Cross-chain architectures face the challenge of connecting networks with different consensus mechanisms, block times, and security models. Bridges must handle these disparities while maintaining security and performance standards.

Multi-chain architectures benefit from standardized communication protocols and shared security models. All chains in the ecosystem speak the same “language,” reducing complexity and potential attack vectors.

Cross-chain solutions often introduce additional trust assumptions through bridge operators or validator sets. Multi-chain ecosystems can leverage shared validator sets and cryptographic guarantees for enhanced security.

Security Models and Risk Factors

Cross-chain bridges represent attractive targets for attackers due to their asset custody role. Bridge exploits have resulted in billions of dollars in losses, highlighting the security challenges of connecting disparate networks.

Multi-chain ecosystems distribute risk across the entire network rather than concentrating it in bridge contracts. Shared security models mean that attacking one chain requires compromising the entire ecosystem’s security.

Cross-chain solutions face the “weakest link” problem where the security of asset transfers depends on the least secure component in the bridge architecture. Multi-chain platforms can maintain consistent security standards across all interconnected chains.

Performance and Scalability

Cross-chain transactions often require multiple confirmations and verification steps, leading to longer settlement times compared to native transactions. Bridge congestion can create bottlenecks during high demand periods.

Multi-chain architectures enable horizontal scaling by adding new chains for specific use cases or user groups. This approach can theoretically provide unlimited throughput as demand grows.

Cross-chain solutions are limited by the performance characteristics of the connected networks and the bridge infrastructure. Multi-chain ecosystems can optimize each chain for its intended purpose while maintaining interoperability.

Use Cases and Applications

Both approaches serve different market needs and use cases. Understanding these applications helps identify the most suitable solution for specific requirements.

Cross-Chain DeFi Solutions

Decentralized finance benefits significantly from cross-chain connectivity. Users can access liquidity pools on different networks, arbitrage price differences, and compose complex strategies across multiple protocols.

Cross-chain yield farming allows users to optimize returns by accessing opportunities on various networks without manually bridging assets. Automated strategies can rebalance positions across chains based on yield differentials.

Multi-protocol lending platforms leverage cross-chain bridges to provide unified interfaces for borrowing and lending across different networks. Users can collateralize assets on one chain while borrowing on another.

Multi-Chain dApp Development

Multi-chain platforms excel at creating application specific chains optimized for particular use cases. Gaming applications can deploy chains with faster block times and lower fees while maintaining ecosystem connectivity.

Enterprise applications benefit from private or consortium chains within multi-chain ecosystems. These chains can implement custom governance and compliance features while accessing public ecosystem services.

NFT marketplaces can operate across multiple chains within an ecosystem, providing seamless user experiences without complex bridging processes. Artists and collectors benefit from unified discoverability and liquidity.

Advantages and Disadvantages

Cross-Chain Benefits and Limitations

Cross-chain solutions offer immediate connectivity to existing blockchain networks with established user bases and liquidity. Projects can access multiple ecosystems without rebuilding on new platforms.

The approach preserves network sovereignty, allowing each blockchain to maintain its governance, tokenomics, and technical roadmap. Users benefit from choice and competition between different protocols.

However, cross-chain bridges introduce security risks and complexity. Each bridge represents a potential point of failure, and the proliferation of bridge protocols can fragment liquidity and user experiences.

Bridge transactions often incur higher fees and longer confirmation times compared to native transfers. Users must understand multiple interfaces and security models, creating friction and potential confusion.

Multi-Chain Pros and Cons

Multi-chain ecosystems provide seamless interoperability and consistent user experiences across all connected chains. Developers can focus on application logic rather than complex bridge integrations.

Shared security models reduce the risk profile compared to independent bridge validators. Ecosystem governance can coordinate upgrades and security improvements across all chains simultaneously.

The approach enables unlimited scalability through horizontal expansion. New chains can be added as needed without impacting existing network performance or security.

Multi-chain platforms face ecosystem lock-in effects where moving to different platforms requires significant migration efforts. Early design decisions can constrain future development options.

Ecosystem governance can become complex as the number of chains and stakeholders grows. Coordinating upgrades and resolving conflicts across multiple chains requires sophisticated governance mechanisms.

Technical Implementation Challenges

Bridge Security Vulnerabilities

Cross-chain bridges face unique security challenges due to their custodial nature and complex verification requirements. Smart contract vulnerabilities can drain bridge reserves, while validator compromises can enable unauthorized transfers.

The “N of M” multisig model commonly used in bridges creates trade-offs between security and liveness. Higher signature thresholds improve security but increase the risk of funds becoming inaccessible if validators become unavailable.

Oracle dependencies introduce additional attack vectors where price feed manipulation or oracle failures can trigger incorrect bridge operations. Robust oracle networks and circuit breakers help mitigate these risks.

Consensus Mechanism Complexities

Multi-chain ecosystems must coordinate consensus across multiple chains while maintaining performance and security. Shared security models require careful design to prevent cascade failures across the ecosystem.

Validator assignment and rotation across multiple chains creates operational complexity. Ensuring adequate security for all chains while maintaining decentralization requires sophisticated staking and delegation mechanisms.

Cross-chain message ordering and finality guarantees become complex when dealing with chains with different block times and finality characteristics. Establishing consistent ordering across asynchronous networks requires careful protocol design.

Cost Analysis and Transaction Fees

| Cost Factor | Cross-Chain | Multi-Chain |

|---|---|---|

| Bridge Fees | 0.05% – 0.3% of transfer value | Not applicable |

| Gas Fees | Two-chain gas costs | Single ecosystem gas |

| Slippage | Variable based on liquidity | Minimal within ecosystem |

| Time Cost | 10-30 minutes typical | 1-5 minutes typical |

| Operational Overhead | Bridge monitoring and management | Ecosystem participation |

Cross-chain transactions typically incur fees on both source and destination chains plus bridge operator fees. These costs can accumulate significantly for frequent cross-chain activity or small value transfers.

Multi-chain ecosystems often feature unified fee structures and gas tokens, simplifying cost calculations and user experiences. Shared security models can distribute costs more efficiently across the ecosystem.

Fee volatility affects cross-chain solutions more severely due to dependencies on multiple networks. Multi-chain platforms can implement ecosystem-wide fee stabilization mechanisms and predictable pricing models.

Developer Experience and Tools

Cross-chain development requires understanding multiple blockchain environments, bridge protocols, and security considerations. Developers must handle varying APIs, development tools, and deployment processes across different networks.

Multi-chain platforms typically provide unified development environments with consistent APIs and tooling across all ecosystem chains. This standardization reduces development complexity and accelerates time-to-market for applications.

Cross-chain solutions benefit from the maturity of existing blockchain ecosystems and established developer communities. Multi-chain platforms may have smaller but more focused developer ecosystems with specialized tooling.

Testing and debugging cross-chain applications presents unique challenges due to the complexity of multi-network interactions. Multi-chain platforms can provide integrated testing environments that simulate the entire ecosystem.

Future Outlook for 2025 and Beyond

The blockchain interoperability landscape continues evolving with new protocols and architectural innovations. Zero-knowledge proofs enable more efficient and secure cross-chain communications through cryptographic verification rather than trust-based systems.

Modular blockchain architectures are converging cross-chain and multi-chain approaches. These systems allow mixing and matching consensus, execution, and data availability layers while maintaining interoperability.

Regulatory developments will significantly impact interoperability solutions. Cross-chain bridges may face increased scrutiny due to their custodial nature, while multi-chain ecosystems might benefit from clearer regulatory frameworks.

The rise of application specific blockchains drives demand for both cross-chain connectivity and multi-chain platforms. Projects increasingly require specialized chains optimized for their particular use cases while maintaining ecosystem connectivity.

Choosing the Right Approach

Project requirements should drive the choice between cross-chain and multi-chain approaches. Applications requiring immediate access to existing liquidity and user bases may benefit from cross-chain solutions.

New projects with specific performance or governance requirements might prefer multi-chain platforms that allow custom chain deployment. The trade-off involves ecosystem size versus optimization potential.

Security requirements play a crucial role in the decision. Projects handling high value assets might prefer multi-chain platforms with shared security models over bridge based solutions with additional trust assumptions.

Long-term strategy considerations include ecosystem lock-in effects, migration complexity, and alignment with future protocol developments. The rapidly evolving landscape requires flexible approaches that can adapt to new technologies and market conditions.

Conclusion

The distinction between cross-chain and multi-chain approaches represents different philosophies for achieving blockchain interoperability. Cross-chain solutions provide immediate connectivity to existing networks while preserving sovereignty and choice. Multi-chain platforms offer seamless integration and shared security at the cost of ecosystem lock-in.

Both approaches continue evolving with technological improvements and market demands. Cross-chain solutions are becoming more secure and efficient, while multi-chain platforms are expanding their capabilities and ecosystem support. The future likely involves hybrid approaches that combine the benefits of both paradigms.

Success in the interoperable blockchain landscape requires understanding these fundamental differences and their implications for security, performance, and user experience. As the ecosystem matures, projects must carefully evaluate their requirements and choose approaches that align with their long-term objectives and risk tolerance.

FAQs

What are the main security risks of cross-chain bridges?

Cross-chain bridges face several security risks including smart contract vulnerabilities, validator compromises, and oracle manipulation attacks. The custodial nature of bridges creates attractive targets for hackers, with over $2 billion lost to bridge exploits in recent years. Multi-signature schemes and time delays help mitigate these risks but cannot eliminate them entirely.

How do transaction costs compare between cross-chain and multi-chain solutions?

Cross-chain transactions typically cost more due to fees on multiple networks plus bridge operator charges, ranging from 0.05% to 0.3% of transfer value. Multi-chain solutions usually offer lower costs with unified fee structures and shared gas tokens, making frequent transactions more economical within the ecosystem.

Which approach offers better scalability for high-throughput applications?

Multi-chain architectures provide superior scalability through horizontal expansion, allowing unlimited chain additions as demand grows. Cross-chain solutions are constrained by bridge capacity and the performance of connected networks, making them less suitable for high throughput applications requiring consistent performance.

Can projects use both cross-chain and multi-chain technologies simultaneously?

Yes, hybrid approaches are increasingly common where projects deploy on multi-chain platforms while maintaining cross-chain bridges to external networks. This strategy provides ecosystem benefits while preserving access to external liquidity and user bases, though it increases complexity and security considerations.

What factors should developers consider when choosing between these approaches?

Developers should evaluate immediate liquidity needs, long-term scalability requirements, security risk tolerance, and development complexity preferences. Projects requiring access to existing ecosystems benefit from cross-chain solutions, while those needing custom optimization and seamless interoperability prefer multi-chain platforms.

- What is One Challenge in Ensuring Fairness in Generative AI: The Hidden Bias Problem - August 15, 2025

- How Small Language Models Are the Future of Agentic AI - August 15, 2025

- What Are the Four Core Characteristics of an AI Agent? - August 15, 2025